Rural Health Statistics

Everybody continues to hear about the dwindling access to healthcare opportunities, but aren’t aware of them unless it directly effects them as individuals… Today, we wish to help put into visual text what has been said, and give a more direct approach to the information people are seeking…

Rural and Critical Access Hospitals

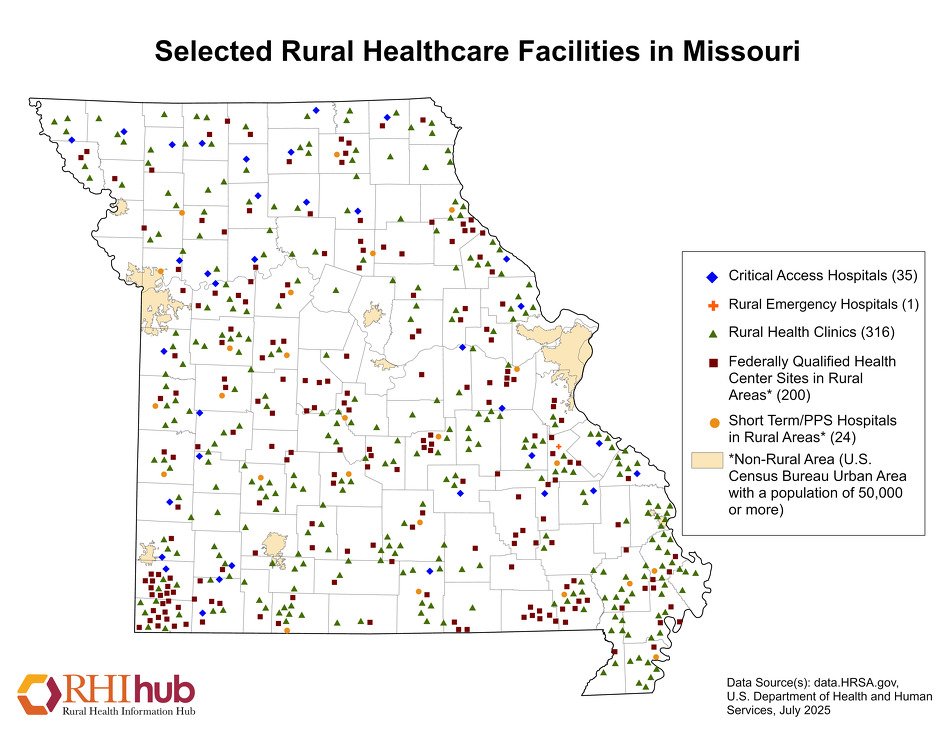

This sector is semi-stable at the moment, due to the protections under Critical Access & Federal Office of Rural Health Policy designation as Rural Hospitals, but still leaves opportunity for expansion to truly meet patient needs. As can be seen by the image below, hospital access across Missouri can be limited in several regions outside of the common metropolitan spaces. With only 60 Critical Access, Short-Term, or Rural Emergency hospitals available to the rural regions (which constitute the overwhelming majority of Missouri citizens), these populations are already under-served. Add to this the primary care and pharmacy closures across these same regions, patients continue to suffer due to lack of access.

Pharmacy Closures

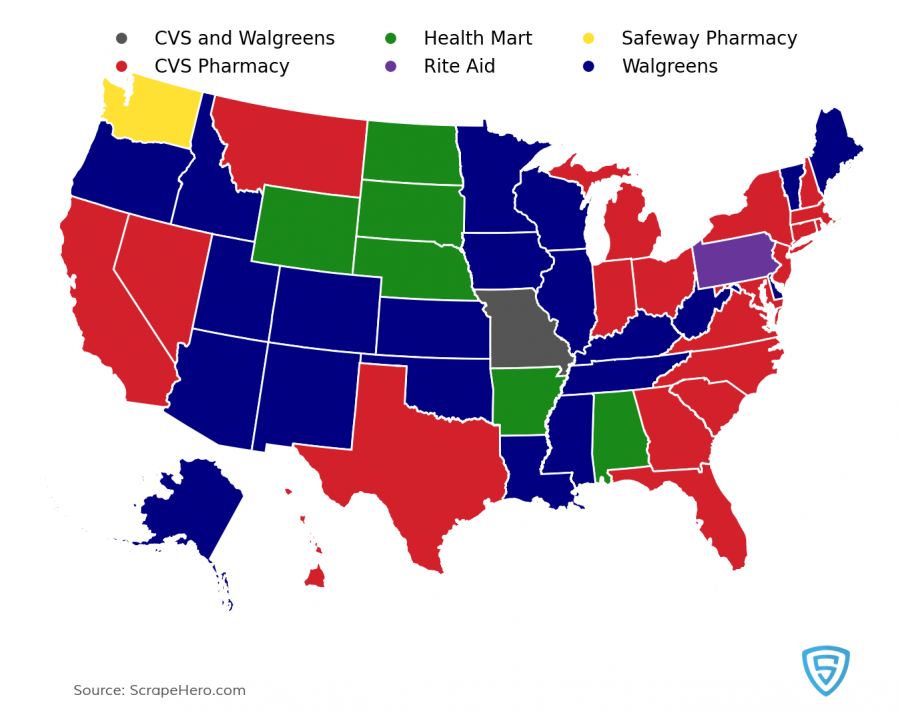

Nearly 30% of pharmacies nationwide closed between 2010 & 2021 with the greatest effect upon the most vulnerable of communities… While the early half of that span saw numerous chain acquisitions of smaller pharmacies and groups (including Target, USA Drug, Rite Aid, etc.), the latter half saw a dramatic shift in closures rather than acquisitions – including amongst those same chain pharmacies! With continued decreasing trends across all healthcare opportunities, patients watching their community pharmacies close continue to put even greater pressures on their ability to maintain safe healthcare goals.

Healthcare Workforce

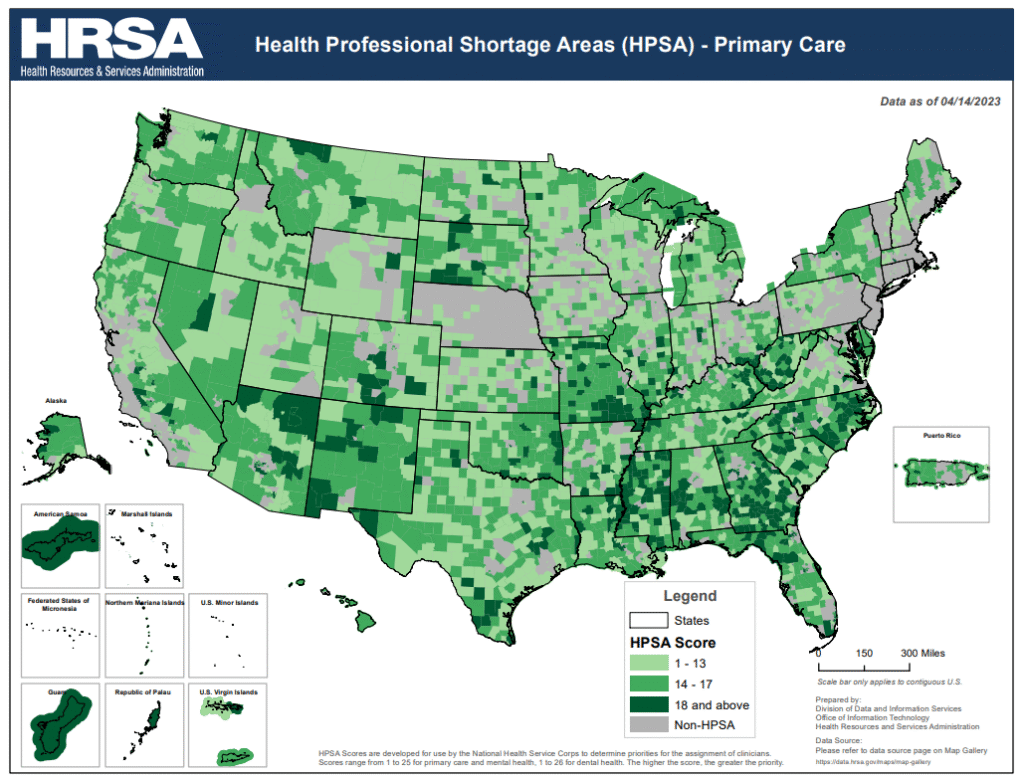

While patients continue to see closing healthcare resources, many believe that would lead to an increased availability of providers across the board. However, the opposite is finding to be true in retail access; although numerous programs have graduated a national level similar to previous years, greater demand is occurring away from community retail settings as the employment numbers for non-traditional retail options are on the rise (internal med, ambulatory care, outpatient clinics, etc.) that don’t typically serve primary retail patient needs and projected graduates are on the decline. These staggering declines are yet another driving force leading to retail closures, as business security doesn’t exist in the minds of several of these practitioners. In addition to these factors, the high-demand for providers near the graduate school programs, which often are located within highly-populated urban metropolitan cities, often lead to providers settling with a job near their existing location of education and do not fulfill the needs of the rural regions, leaving those highest-need communities again “holding the bag” and not able to experience proper healthcare as those in the larger cities have access.

What Does This Mean for Me?

Since 2010, the pharmacy industry has shifted from an expanding, diversified footprint dominated by retail chain growth to a phase of market contraction in physical locations, persistent supply chain and workforce pressures, and evolving service models. Independently owned pharmacies remain pivotal in rural settings, but closures and workforce shortages threaten their viability. Mail order and online pharmacies are growing but do not fully replace in-person access. Rural disparities seen in pharmacy access are mirrored in other healthcare facility shortages (primary care, hospitals, urgent care), with Missouri reflecting these national patterns acutely.

Keep your eye on anything available to help your community pharmacy staffed and open for your availability. Continue to work together as community investors to ensure the longevity of healthcare access in your community. Find opportunities to help – ask your local healthcare teams how that looks for you!

In general: find ways to ensure the voices of your local healthcare opportunities are heard! Join us in signing our petition to the Federal Trade Commission to expedite changes to PBM’s that ensure local pharmacies (independents, Walgreens, HealthMart, WalMart, etc.) all are able to stay in your neighborhood – before it is too late! To join in our voice, click the yellow button above to go to our petition and complete the form today!

Rural & Critical Access HealthCare Facilities in Missouri, July 2025 US DHHS HRSA.gov Data

Most Prevalent Pharmacy, by State, December 2024 ScrapeHero.com Data

Health Professional Shortage Areas (HSPA), April 2023 DHHS HRSA.gov Data